Figuring depreciation on equipment

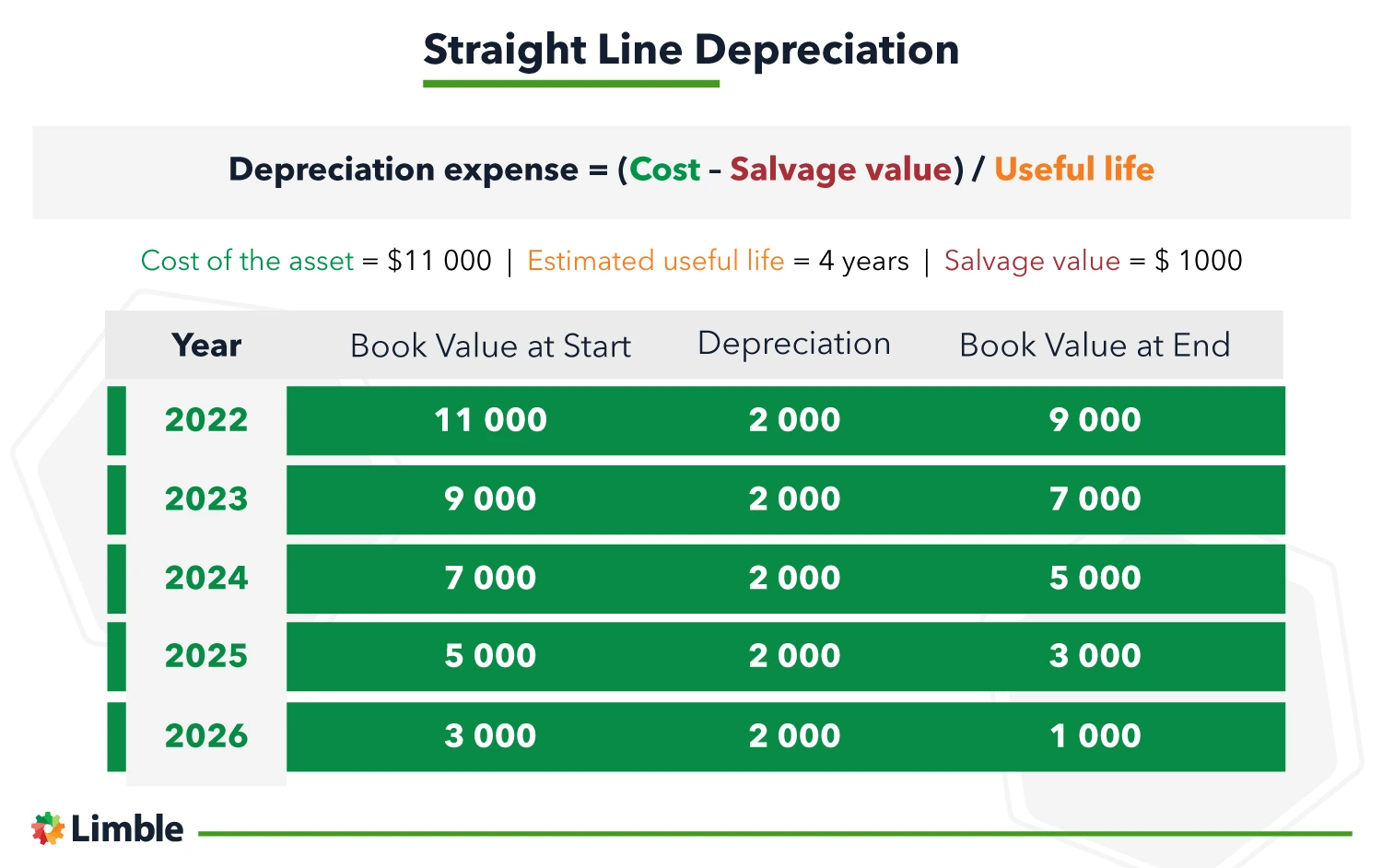

With this method you can split your assets value evenly across its useful life. To calculate depreciation using the straight-line method subtract the assets salvage value what you expect it to be worth at the end of its useful life from its cost.

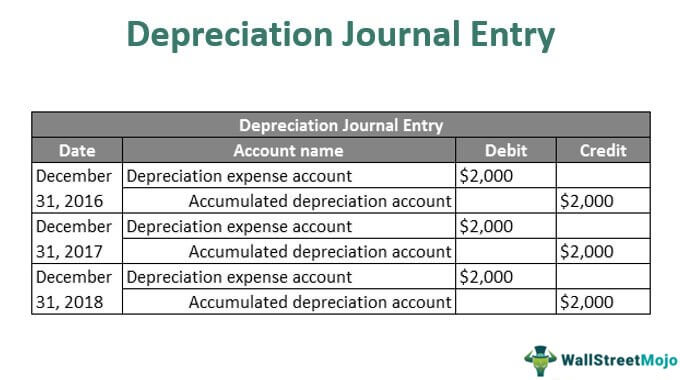

Depreciation Journal Entry Step By Step Examples

Calculation through sum of years digits method.

. Net Book Value Depreciation rate. The straight-line depreciation method is the easiest to calculate and the annual depreciation amount original net value of assets-estimated residual value service life. The formula to calculate depreciation through the double declining method is as follows.

Return to top 5 If I owe money on an asset can I still depreciate it. Depreciation Office equipment cost Office equipment salvage value. The formula for calculating equipment deprecation is centered around three things.

Salvage value cost value annual depreciation x useful life If you have construction equipment that you bought for 200000 you can use the depreciated value at. To calculate depreciation subtract the. Yes as long as you are responsible for making.

The syntax is SYDcost salvage life per with per defined as the period to calculate the depreciation. Companies can use the following formula to calculate office equipment depreciation. The unit used for the period must be the same as the unit used for.

Where the NBV of the asset is cost less accumulated. Sum of digits depreciation depreciable cost x balance useful lifesum of years digits example. 60 for business use depreciation can be claimed on 60 of the cost.

Initial value purchase price Useful life Salvage value. The straight-line depreciation method is the easiest way to calculate depreciation on business equipment. Depreciable Amount Remaining Useful Life at the Start of Year Sum of Years Digits Where depreciable.

The formula to calculate depreciation through sum of years digits is as follows.

Depreciation Rate Formula Examples How To Calculate

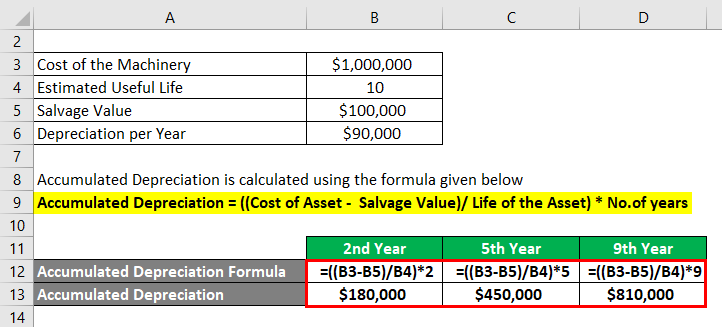

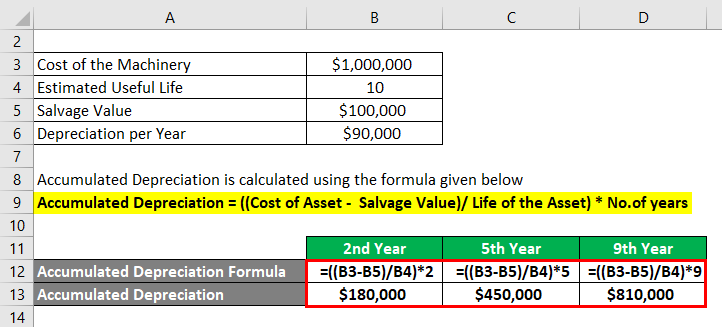

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Formula Calculate Depreciation Expense

Accumulated Depreciation Explained Bench Accounting

Depreciation Formula Calculate Depreciation Expense

Manufacturing Equipment Depreciation Calculation Depreciation Guru

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Equipment Depreciation Basics And Its Role In Asset Management

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Manufacturing Equipment Depreciation Calculation Depreciation Guru

Furniture Fixtures And Equipment Depreciation Calculation Depreciation Guru

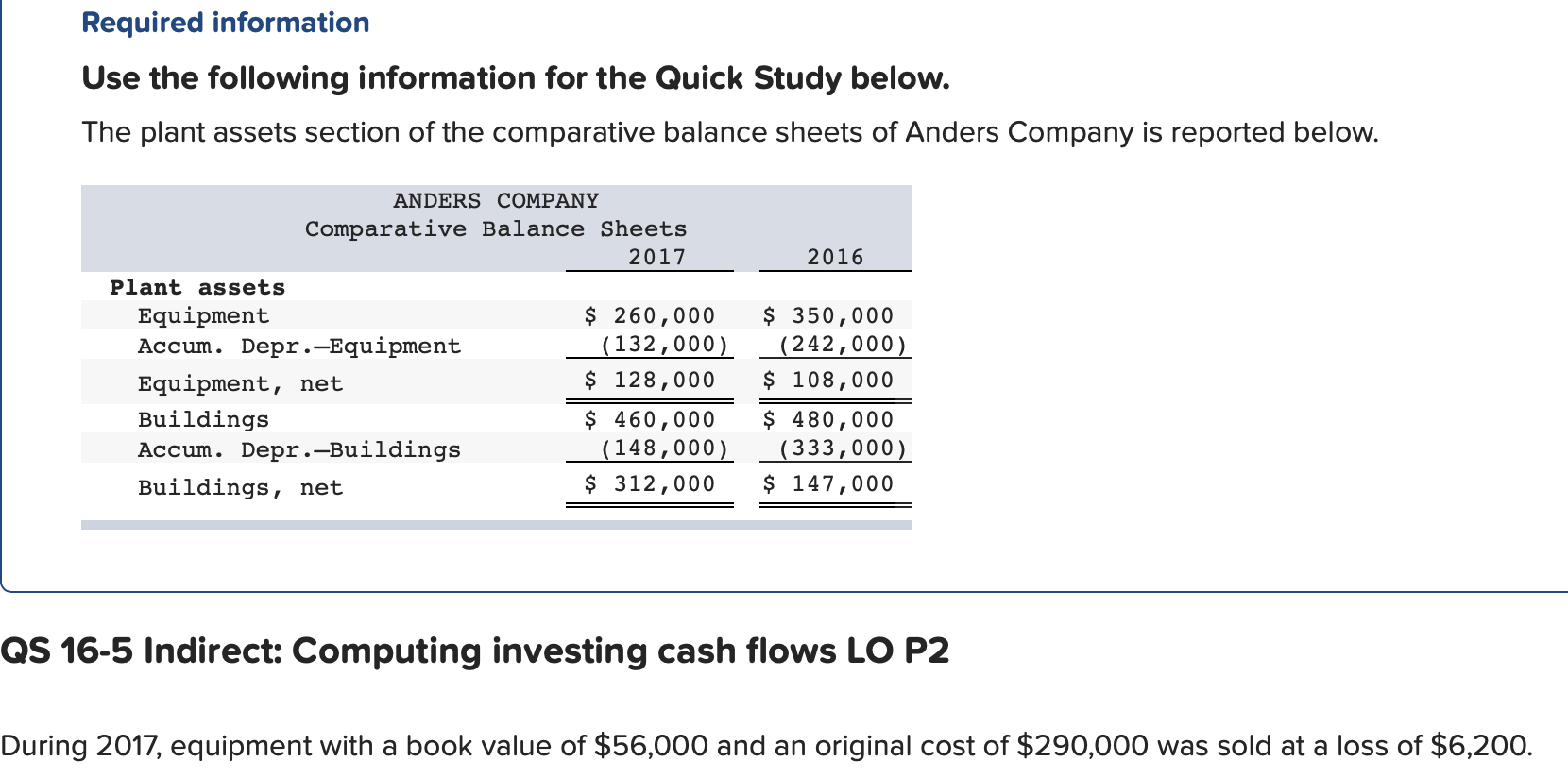

Solved How Do I Calculate The Depreciation Expense And Cost Chegg Com

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation On Equipment Definition Calculation Examples

Equipment Depreciation Planning Engineer Est

Depreciation Nonprofit Accounting Basics

Computer Related Equipment Depreciation Calculation Depreciation Guru